Give to Chuck’s Gift via Cash, Securities, and Mutual Funds

All funding for Chuck’s Gift goes directly to the outreach and costs to keep the project going. Chuck’s Gift is currently a 100% volunteer

organization, and NO ONE RECEIVES A SALARY. Your generous gift is the only means to allow Chuck’s Gift to reach pets and their families in need

to help save pet’s lives. We respectfully ask for your valuable assistance and generosity to help our efforts. PLEASE NOTE: The scope of our

outreach is directly relative to the donations that we receive. Please contact us with any questions, comments, or concerns. Please review the

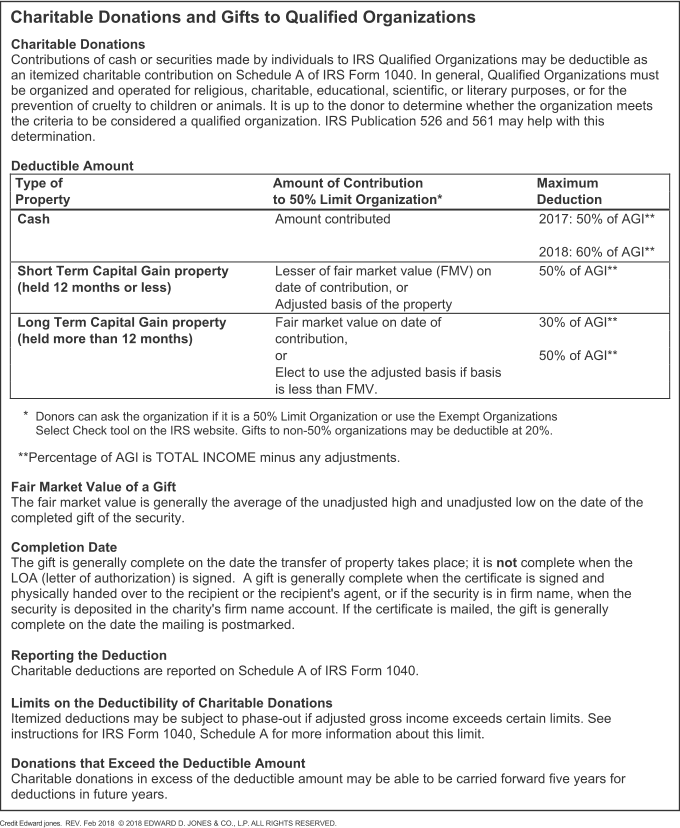

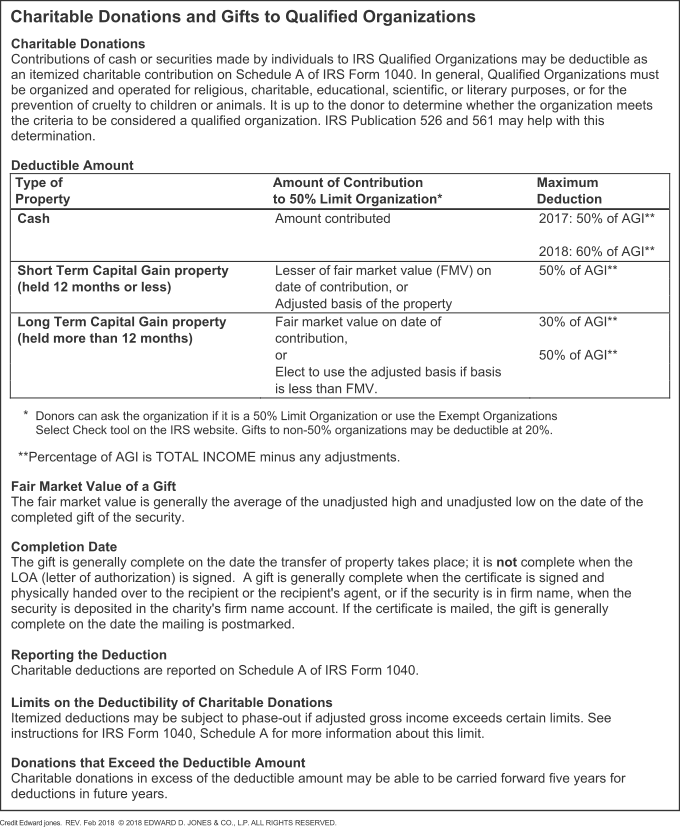

following Charitable Donations and Gifts to Qualified Organizations below. Click the button below to request the Chuck's Gift - Gifting Cash,

Securities, and Mutual Funds for donation instructions and delivery options form to begin giving. Thank you!

Give to Chuck’s Gift via Cash, Securities, and Mutual Funds

All funding for Chuck’s Gift goes directly to the outreach and costs to keep the project going.

Chuck’s Gift is currently a 100% volunteer organization, and NO ONE RECEIVES A SALARY. Your

generous gift is the only means to allow Chuck’s Gift to reach pets and their families in need

to help save pet’s lives. We respectfully ask for your valuable assistance and generosity to help

our efforts. PLEASE NOTE: The scope of our outreach is directly relative to the donations that

we receive. Please contact us with any questions, comments, or concerns. Please review the

following Charitable Donations and Gifts to Qualified Organizations below. Click the button

below to request the Chuck's Gift - Gifting Cash, Securities, and Mutual Funds for donation

instructions and delivery options form to begin giving. Thank you!

Give to Chuck’s Gift via

Cash, Securities, and Mutual Funds

All funding for Chuck’s Gift goes directly to the

outreach and costs to keep the project going. Chuck’s

Gift is currently a 100% volunteer organization, and

NO ONE RECEIVES A SALARY. Your generous gift is

the only means to allow Chuck’s Gift to reach pets

and their families in need to help save pet’s lives. We

respectfully ask for your valuable assistance and

generosity to help our efforts. PLEASE NOTE: The

scope of our outreach is directly relative to the

donations that we receive. Please contact us with

any questions, comments, or concerns. Please

review the following Charitable Donations and Gifts to

Qualified Organizations below. Click the button below

to request the Chuck's Gift - Gifting Cash, Securities,

and Mutual Funds for donation instructions and

delivery options form to begin giving. Thank you!

Please use a device with a larger screen to view the

Charitable Donations and Gifts to Qualified

Organizations document.